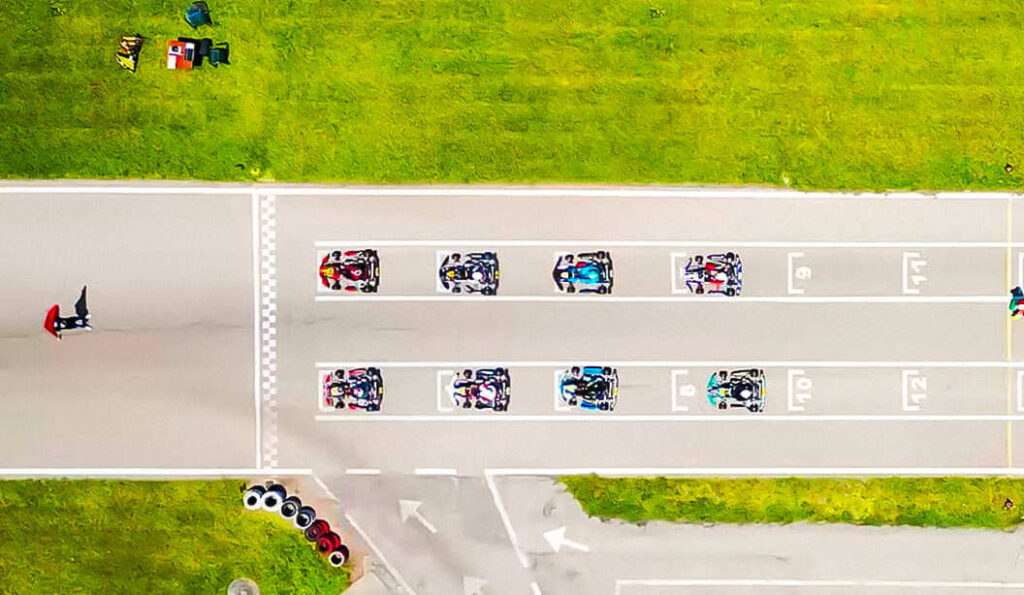

Pista kart

noleggio

Mettiamo a tua disposizione una pista da 840mt con rettilineo da 160mt aperta fino a notte fonda. Non ti basta? Offriamo anche servizi di riparazione, assistenza per gare di campionato, e ti aiutiamo a inserirti nel mondo delle competizioni. Pronto a sfrecciare?

I kart

Scegli tra kart monoposto e biposto, mini kart e go kart. Abbiamo anche kart motorizzati Comer 80 cc a due tempi, per sentirti come in una vera e propria gara. Oppure porta il tuo e mostraci cosa sai fare: noleggiamo la pista anche per privati!

- Scoprirai chi è il più veloce

sistema di cronometraggio

Non c’è spazio per le polemiche! La pista è dotata di un sistema di cronometraggio professionale.

i record

Sfida i tuoi amici e scopri chi è il più veloce

Andrea Zollino

80 cc // 2 tempi-

55.26

°

Federica Carluccio

80 cc // 2 tempi-

55.50

°

Lorenzo Martina

80 cc // 2 tempi-

55.52

°

Gareggia con gli amici: chi è il più veloce?

recensioni

Cosa dicono di noi

Posto molto divertente, per grandi e piccini.

La pista è grande, il personale disponibile e gentile. Vi sono tavoli e sedie dove poter sostare per osservare le corse. All’interno si trova anche un bar. I miei figli si sono divertiti tanto… 5 stelle li vale tutti!

Marianna Mangione

Posto molto carino per passare una serata con amici nello sfidarsi sui Go-kart.

Consiglio come esperienza, ne vale la pena anche per i prezzi abbastanza bassi rispetto alla media

Matteo Tambone

Bella pista con spazi ampi di sicurezza. Kart ben tenuti e di buon livello, personale professionale. Prezzi accessibili. Consiglio per una bella serata di svago.

Andrea Albanese

Precedente

Successivo